It won’t integrate with your accountant’s tax software. YNAB won’t handle your asset depreciation.

YNAB won’t send your invoices for you (though you can actually track them pretty well in YNAB).

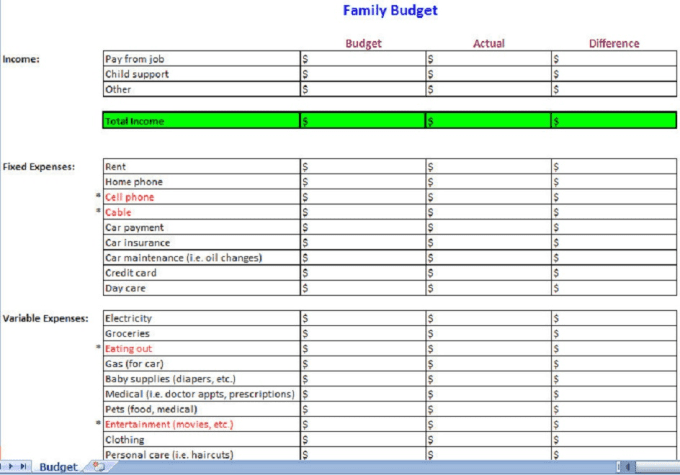

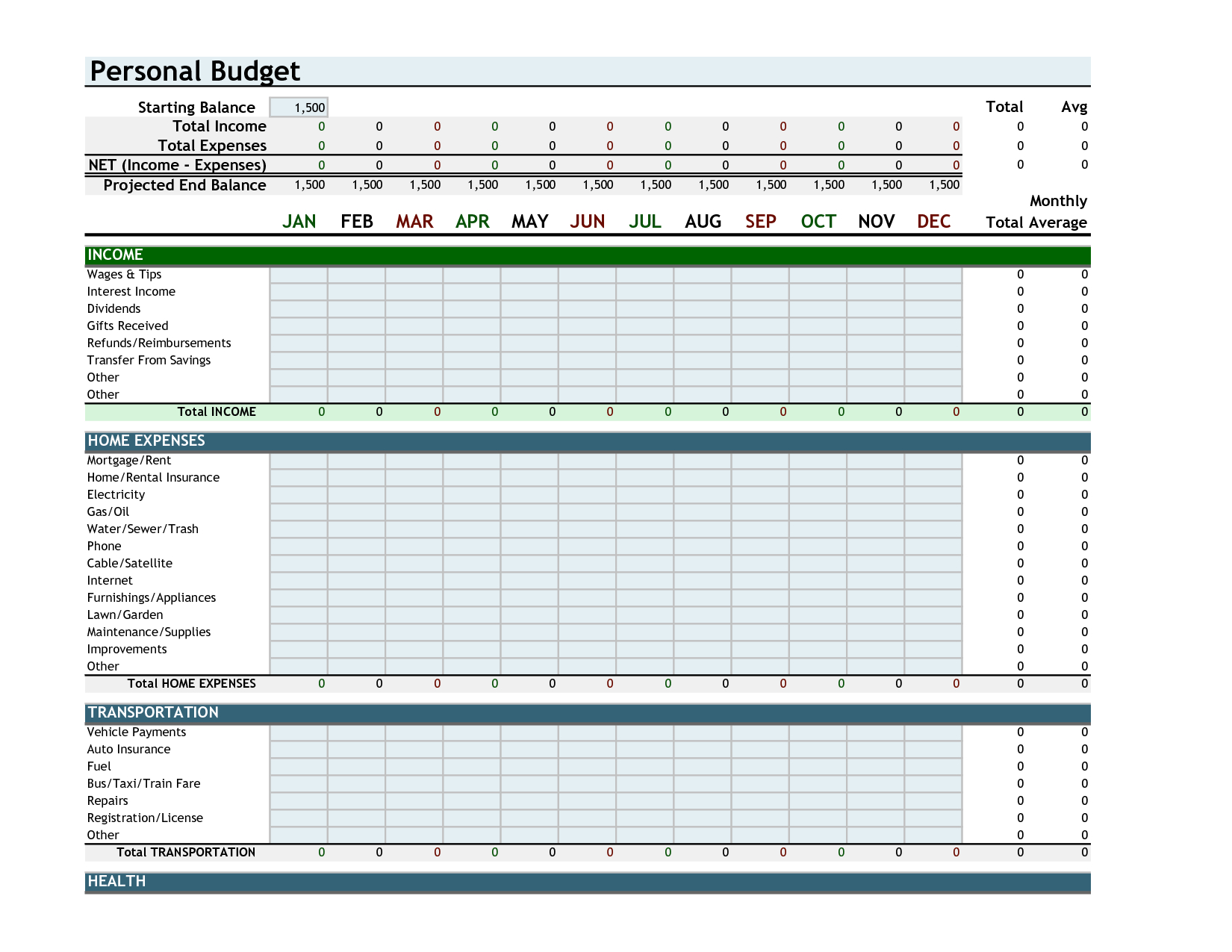

business expenses, etc.) Wait a Minute, YNAB Won’t… It will make everything easier (taxes, reconciliation, personal vs. Go to File -> Create a New Budget… and get started. Unless you have the teeniest of tiny little side operations (where a separate master category for the entire business suffices), you need to set up a separate business budget. In order to do this right though, you need to set up a separate business budget. It will help the risk-taker pull back a little bit, and be more calculated in his or her risks as well. It will help the risk-avoider take calculated, comfortable risks. Yes, I believe YNAB (the software) will serve your small business very well, it did mine. We went from a company with seven part/full-time team members, to a company with 27 over a two-year period.Īll because I used YNAB, where it settled my stomach, and helped me conquer the natural risk aversion I had to hiring people, and growing the business. I saw I could be more aggressive with advertising, because I saw that we had advertising dollars where they were supposed to be. I no longer had to wonder if we could hire, because I could see that our category for payroll was doing just fine. I suddenly had clarity surrounding the business checking account balance. Then I moved YNAB from Quickbooks to YNAB. It gave me what I call, “pile-of-money clarity.” Many years ago, YNAB was profitable with a very small team, and I couldn’t have been happier. YNAB will serve your small business well. You Need a Separate Business Budget (YNASBB-nope, that doesn’t work.

0 kommentar(er)

0 kommentar(er)